voluntary life and ad&d election

Voluntary life insurance is a form of group life insurance in which an employer takes out a supplemental life insurance policy on behalf of their employees to provide them with additional coverage. Employees electing voluntary life will also have the opportunity to elect coverage on their spouse andor children.

Yes this is a 100 employee paid benefit.

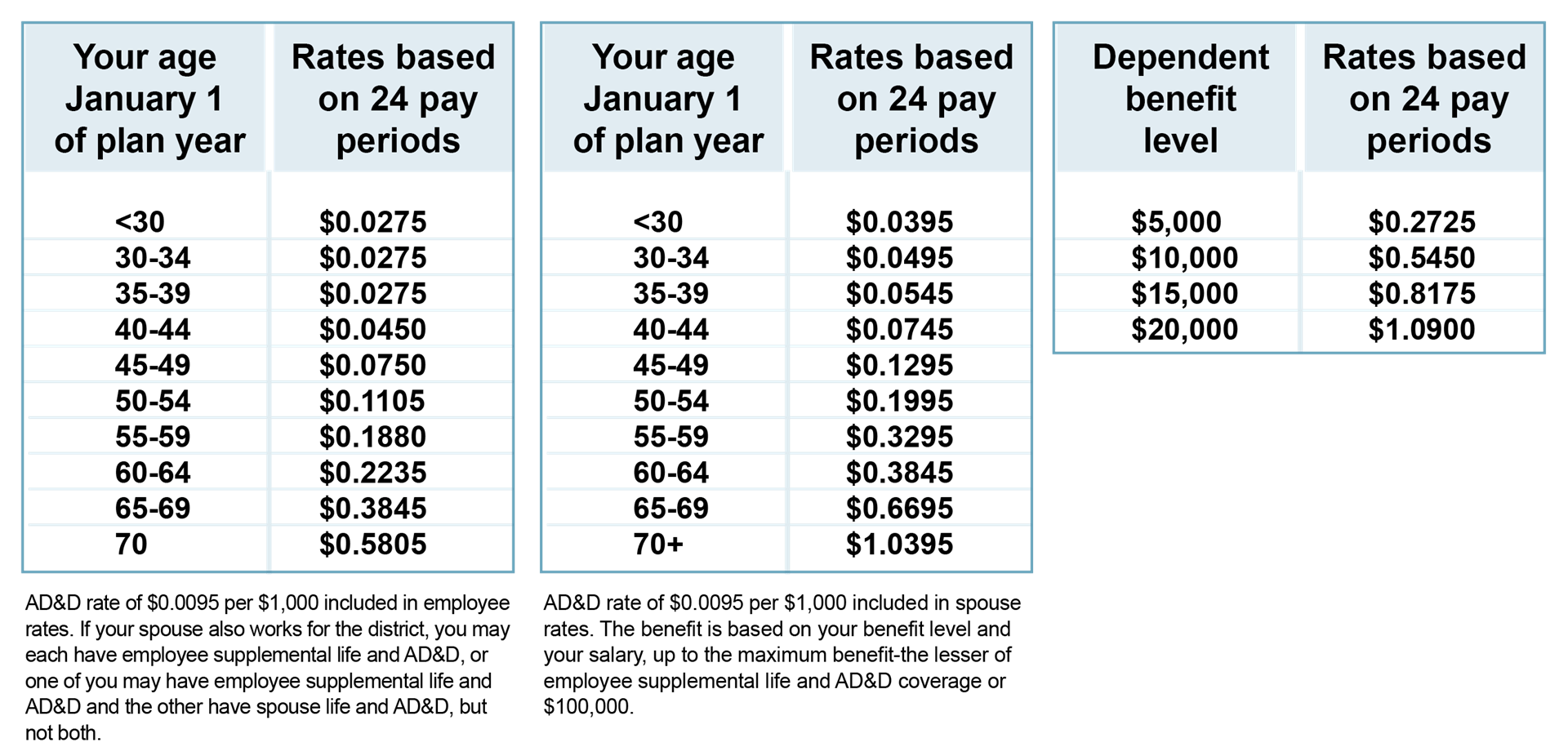

. Rates will change based on the coverage elected and your age throughout the life of your plan. Specifically when an employer offers group term life insurance as part of a group of individual contracts provided to a group of employees these premiums may be taken on a pre-tax basis under a Section 125 Cafeteria Plan. Monthly premium payments are deducted in two 2 installments from the first two 2 pay periods of each month.

The premiums for voluntary term life are based on your age. For losses other than accidental loss of life the Voluntary ADD benefit will be based on the coverage you elect the make up of your family if you elect family coverage and the type of accidental loss. These policies provide a payout to your beneficiaries if you die or receive a qualifying injury due to an accident such as being hit by a car.

If you do not enroll in voluntary life and ADD within 31 days of your hire date you will have to wait until Open Enrollment in October. Voluntary term life insurance is the most common type of voluntary life insurance offered to employees. Voluntary Life and ADD Benefits Mutual of Omaha If you want a greater level of protection City of Ennis provides you with the opportunity to elect Voluntary Life Insurance on yourself as well as your family.

To understand the special characteristics of voluntary life programs some general knowledge of basic group term life programs and Section 79 of the Internal Revenue Code is helpful. 75 of Life benefit before age 65. Life and ADD plans can be added separately in the Voluntary Life plan type and Voluntary ADD plan type.

Additionally if your death is a result of an accident or if you become dismembered your Accidental Death Dismemberment ADD coverage may apply. The cost of ADD insurance is lower than that for traditional life insurance because the coverage is limited to accidents only. Rates will vary from insurer to insurer and can start as low as 450 per month for 100000 of coverage.

Like any other life insurance program voluntary life insurance doles out a payment or death benefit to the beneficiary in your plan upon your death. Voluntary Life and ADD. Section 79 is a part of the Internal Revenue Code that affects plans of group term life insurance purchased by an employer for an.

See the chart in the 2022 HSHS Benefits Guide and the Voluntary ADD SPD for more details. However if employees automatically receive ADD and at the same coverage amount as Life the best practice is to combine into one plan and add in the Voluntary LifeADD. Life insurance will provide family members or other beneficiaries with financial protection and security.

Voluntary Life ADD. Features of the Plan Your employers plan includes Voluntary Accidental Death and Dismemberment ADD Insurance which would pay an additional benefit up. Voluntary accidental death and dismemberment insurance or voluntary ADD insurance is often offered by employers similar to voluntary life insurance.

The employee pays the monthly premium to the insurance company offering the policy. At age 75 50 of original benefit. With term life insurance the employee is covered for a specific term 1 5 10 or 20 years at which time the employee can either cancel or renew the policy.

Pflugerville ISD offers eligible employees term life insurance through The Standard. Voluntary life insurance is an employee benefit option offered by many employers to their employees. The Spouse Rate is based off of the Spouses Age.

Subject to a maximum of 500000 if life expectancy is 6 months or less. You must elect Voluntary Life coverage for yourself in order to cover your spouse andor children. However in that case the value of the coverage that is over 50000 must be included in the employees incomes.

Scheduled BenefitEach eligible employee and spouse may elect an amount of insurance in increments of 10000 from a minimum of 10000 to a maximum of 500000. Group or EmployerCompany-paid Life and ADD is generally offered to employees only. Contents hide 1 Do I need both life insurance and ADD.

What is IRC Sec. The premiums are tied to the amount of basic voluntary life insurance you purchase.

Benefit Information Ancillary Life Ltd Etc Milford Nh

Voluntary Benefits Life And Ad D

Buying Life Insurance At Work Securian Financial

Hartford Supplemental Life And Voluntary Ad Amp D Enrollment Form

1 San Joaquin Delta College New Employer Provided Life Ad D Coverage New Group Voluntary Life Ad D Insurance January 1 St 2013 Initial Enrollment Ppt Download

Voluntary Life And Ad D Insurance Valuepenguin

Employee Life And Ad Amp D Insurance

Ad D Vs Accident Insurance As We Always Point Out In Axis Capital Group Accidents Can Always Happen When You Least Expect It But Accident Insurance Ads Axis

Voluntary Life Insurance The Hartford